CHINA'S CENTRAL BANK RESUMES BUYING GOLD AFTER A SIX-MONTH BREAK

CHINA'S CENTRAL BANK RESUMES BUYING GOLD AFTER A SIX-MONTH BREAK

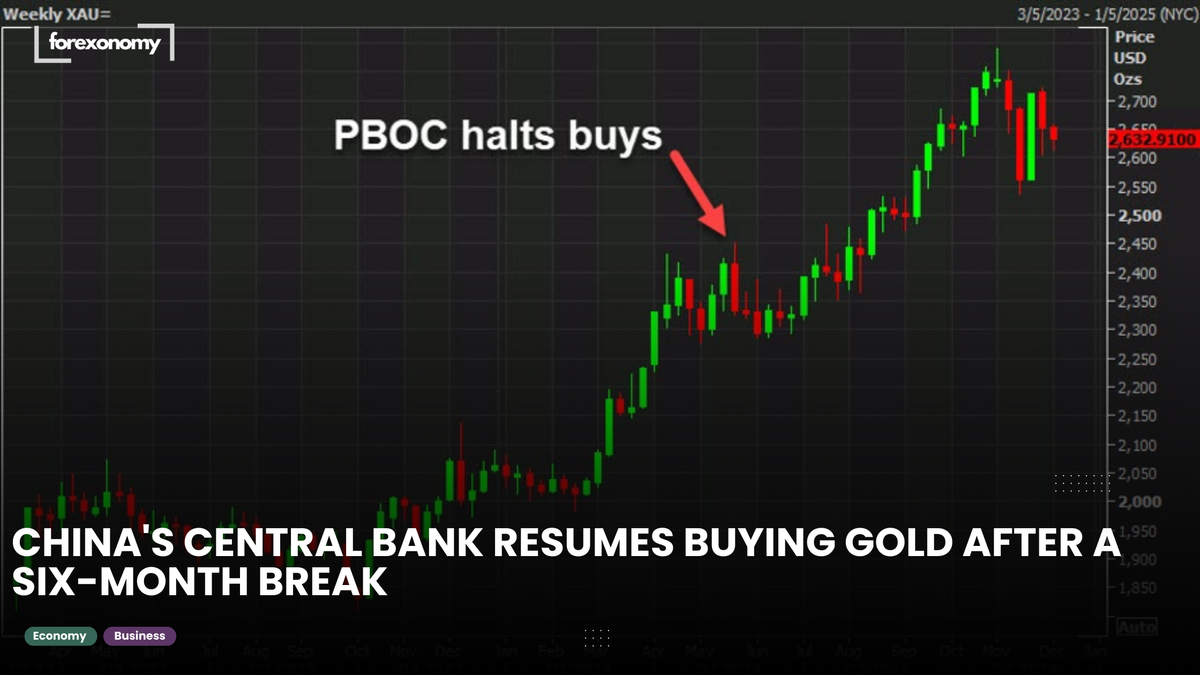

PBOC Resumes Gold Purchases: The People's Bank of China (PBOC) has restarted buying gold after a six-month hiatus.

Largest Official Buyer in 2023: China was the largest official gold buyer globally in 2023, part of its strategy to diversify away from US dollars.

Pause in Buying Earlier This Year: Gold purchases stopped in May after prices rose above $2400, with the PBOC becoming price-sensitive.

Gold Price Impact: The news of the PBOC's shift in June 2024 caused a $100 drop in gold prices.

Increase in Gold Holdings: By the end of November, China's gold holdings rose to 72.96 million fine troy ounces, up from 72.80 million ounces since May.

PBOC's Gold-Buying Strategy: Though China doesn't disclose its strategy, sources suggest they plan to expand gold holdings further, indicating a shift away from waiting for lower prices.

Positive Impact on Gold: The news is expected to generate a positive reaction for gold at market open, especially given the seasonally strong period for gold.